Want to create an investment platform of your own? Navigating the complexities of financial technology can be a challenge, but it’s a rewarding one. We gathered the critical information designed for entrepreneurs, developers, or anyone enthusiastic about finance looking to develop a successful digital investment platform.

Content:

- What is an investment platform?

- What types of investment platforms exist?

- Benefits and drawbacks of investment platforms

- What is the role of digital investment platforms?

- Ten features that define successful investment platforms

- How do you create an investment app with Unicorner?

Let’s walk through the essential steps and strategies to build a platform that stands out in the competitive world of digital finance.

What is an investment platform?

An investment platform is a digital interface that facilitates the participation of people and companies in financial markets. It is an intermediary providing a range of investment management services and tools.

These platforms typically offer capabilities for executing trades, accessing real-time financial market data, conducting research, and managing investment portfolios. They may serve various investment vehicles, including stocks, bonds, mutual funds, and alternative assets like cryptocurrencies.

The evolution of investment platforms reflects the democratization of financial markets, offering both newbies and experienced investors convenient access to investment opportunities.

What types of investment platforms exist?

Investment platforms can take various forms, such as online brokerages offering direct market access, robo-advisors providing automated portfolio management based on algorithms, and peer-to-peer lending platforms enabling loans between individuals without traditional financial intermediaries. Let’s get through them in more detail.

Online brokerages

An online brokerage provides a platform for the hands-on management of investments, appealing to investors who prefer direct control over their trades. They usually offer tools for self-directed trading in stocks, bonds, ETFs, and mutual funds.

Examples: Charles Schwab, Fidelity

Robo-advisors

Think of building an investment platform if your target audience is passive investors. Robo-advisors automate the investment process with minimal need for user intervention and use algorithms to manage investments based on the user’s risk profile and goals.

Examples: Betterment, Wealthfront

Peer-to-peer (P2P) lending platforms

P2P is suitable for investors seeking alternative assets beyond stocks and bonds, offering potentially higher returns at higher risks. These platforms connect borrowers with individual lenders, bypassing traditional banks.

Examples: LendingClub, Prosper

Crowdfunding platforms

With this kind of platform, investors typically fund projects in exchange for rewards or equity, focusing on start-ups and creative projects. Crowdfunding allows entrepreneurs to raise capital for projects from a large number of people.

Examples: Kickstarter, Indiegogo

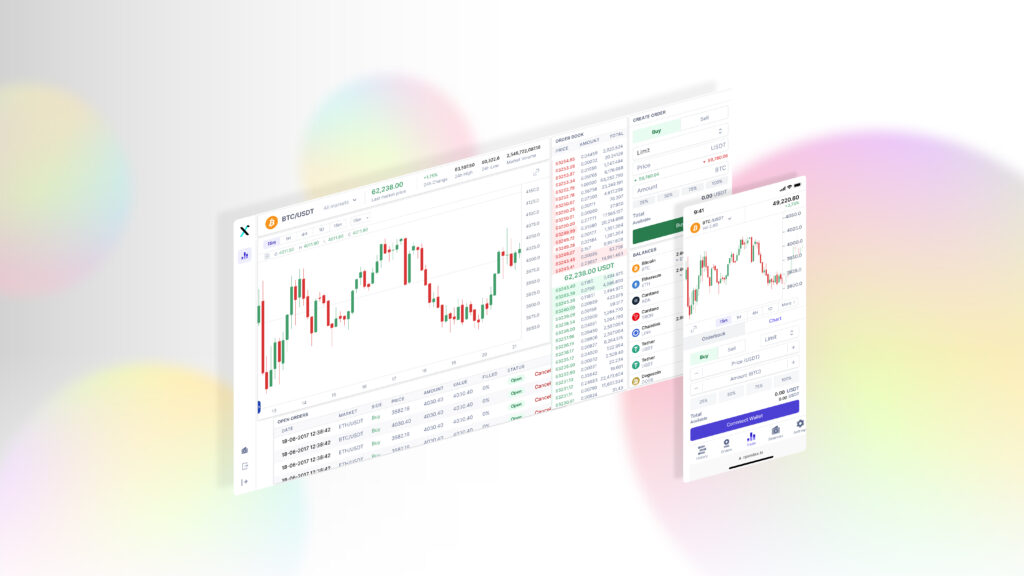

Cryptocurrency investment platforms

In 2024, when aspiring entrepreneurs ask “how to create an investing app,” they quite often mean cryptocurrency platforms, which service investors interested in digital currencies, offering high-risk, high-reward investment plans. These platforms facilitate buying, selling, and trading cryptocurrencies.

Examples: Coinbase, Binance

Social trading platforms

These are beneficial for inexperienced investors who want to use the expertise of skilled traders. Social trading platforms combine elements of social networks with trading, which allows users to follow and copy others’ trades.

Examples: eToro, ZuluTrade

Strategies for investment

Each type of platform described has unique features and helps with different investment strategies, from active trading to passive investment management. Let’s have their quick categorization.

- Active trading involves frequently buying and selling stocks or other financial instruments to capitalize on short-term market movements. Strategies include day trading, swing trading, and scalping, focusing on market trends, technical analysis, and timing. It requires significant time, knowledge, and often a higher risk tolerance.

- Value investing focuses on buying undervalued stocks and holding them for the long term. It involves thorough research to identify stocks trading below their intrinsic value. It is popularized by Warren Buffett.

- Growth investing targets companies expected to grow at an above-average rate compared to other companies in the market. It often involves investing in tech or emerging industries, accepting higher risks for potentially higher returns.

- Dividend investing centers around investing in companies that pay regular dividends. It is suitable for those seeking a steady income stream, often favored by conservative investors.

- Index investing involves buying index funds that track the performance of a market index like the S&P 500. It emphasizes diversification and minimizes the impact of the performance of individual stocks.

- Passive investment management focuses on long-term growth with minimal buying and selling. It often involves investing in mutual funds or ETFs that mirror market indices. It benefits from lower fees and is often more taxes-efficient than active trading.

- Asset allocation involves distributing investments across stocks, bonds, real estate, etc., to balance risk and reward. The allocation depends on individual goals, risk tolerance, and investment horizon.

- Risk management is essential in all investment strategies. It involves understanding and managing the potential losses associated with investment choices.

Benefits and drawbacks of investment platforms

It is clear what pros and cons investment platforms have for a user. They are accessible yet risky; they offer lower costs than traditional brokerage services but are quite complex for beginners; they offer advanced technical analysis tools but can lead to technology dependence.

But what about software development specialists who decided to create an investment app?

| Benefits for owners and developers | Drawbacks for owners and developers |

| Revenue generation: Earning from various fees and charges. | High development costs: Significant initial investments in technology and infrastructure. |

| Market expansion: Ability to reach a global customer base. | Regulation compliance: Navigating complex and varying financial regulations. |

| Data insights: Access to valuable user data for strategic decisions and innovation. | Cybersecurity risks: Ongoing threat of cyberattacks, requiring continuous investment in security. |

| Brand building: Opportunity to establish a reputable brand in the fintech market. | High competition: Intense market competition demanding constant innovation. |

| Innovation leadership: Being at the forefront of financial technology advancements. | User trust and retention: Challenges in building and maintaining user trust, especially in financial data handling. |

What do you think? Is it worth your time and resources?

What is the role of digital investment platforms?

Digital investment platforms are crucial in modernizing and democratizing the stock market and investments. They provide valuable market data, research resources, and fundamental analysis tools to help users make informed investment decisions.

They make financial markets more accessible and manageable for the general public. By lowering entry barriers (like minimum investment amounts) and providing educational resources, these platforms make investing more accessible to a broader audience, making them a tool for equality and integrity in our society.

10 features that define successful investment platforms

Like with every mobile app you would want to create today, there are several requirements you should meet. These are the features most successful investment platforms are defined by.

- User-friendly interface. An intuitive, easy-to-navigate design that enhances usability and user experience.

- Robust security measures. Strong cybersecurity protocols to protect user data and financial transactions from potential threats.

- Diverse investment options. A wide range of investment products and alternative assets.

- Advanced analytical tools. Sophisticated tools for market analysis, portfolio management, and personalized investment recommendations.

- Mobile accessibility. A responsive mobile platform or app allowing users to manage their investments on the go.

- Educational resources. Learning materials and resources to help users make informed investment decisions.

- Transparent fee structure. Clear, straightforward pricing without hidden costs.

- Regulatory compliance. Adhering to financial regulations and standards to ensure legal compliance and build user trust.

- Customer support. Reliable and accessible customer service for user assistance and support.

- Regular updates. Continuous platform updates with the latest technology and features to stay competitive.

How to create an investment app with Unicorner?

Creating an investment app consists of several steps. Some of them, like finding investments for your new project, are entirely up to you, while with others, you can get help from a staff augmentation IT vendor. So, how do you create an investment app with Unicorner?

Step 1. Define your app concept. Clearly articulate your app’s purpose, target audience, and core functionalities. Identify its key features.

Step 2. Establish communication and workflow. Set up regular meetings and communication channels for ongoing coordination. Agree on workflow and project management tools to track progress.

Step 3. Develop a detailed project plan. Work with the outstaffing team to outline the project scope, milestones, and timelines. Include detailed specifications for each app feature and functionality.

Step 4. Focus on compliance and security. Ensure the app complies with financial regulations and data protection laws. Emphasize the importance of robust security measures to protect user data.

Step 5. Design and user experience. Collaborate on the app’s design, prioritizing a user-friendly and intuitive interface. Consider conducting user testing to gather feedback on the app’s usability.

Step 6. Development and testing. Work closely with the outstaffing team during the development phase. Conduct thorough testing, including functional, security, and performance tests.

Step 7. Launch and continuous improvement. Plan for a soft launch to gather initial user feedback. Use feedback for continuous improvement and updates.

***

We are here for you, ready to reinforce your tech team with skilled software developers with a FinTech background. Don’t hesitate to contact Unicorner whenever you have questions about our services and capabilities.